What are your thoughts about a currency in a Parecon? What would it look like?

Throughout the Parecon literature, there is little discussion regarding the monetary system. I was wondering whether any of you had any suggestions as to how this aspect could be operationalized.

My thoughts on this are as follows…

-

In our current economy, there is really just the economy and its health which determines the strength or value of its currency. At one time in our history, a currency was backed by gold. In a Parecon, the currency would be based on the unit of labour. One unit of currency or a credit would be worth one hour of labour for example. The advantage of this is that there is no inflation in a Parecon, the value of a unit of labour or hour of work and its value would remain constant forever. It is an input. Only the output would vary if efficiencies are realized through improving worker productivity for example.

-

I would suggest a digital currency, much like our credit cards or banking cards have replaced cash, so no paper or hard currency made from precious metals. It could be administered using blockchain technology and distributed ledger system much like a cryptocurrency or a central computer like that used for credit cards, the latter being must vulnerable to cyber attacks. This system would serve as a means to issue currency/credits when someone earned it, much like a paycheque every two weeks and it would also serve as a bank account and be used to administer the saving or spending of currency by consumers.

-

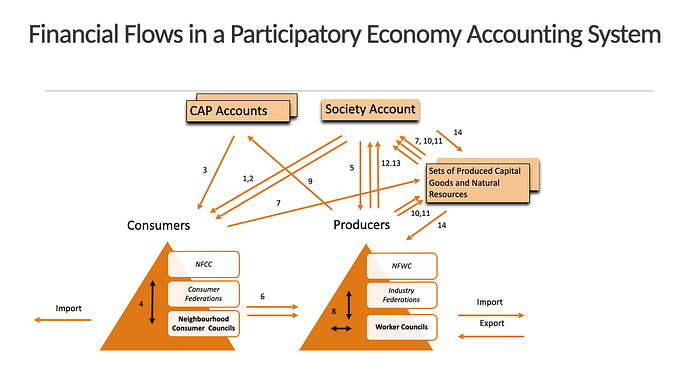

There would be no central bank or federal reserve or local banks. Worker Council budgets, approved by Iteration Facilitation Boards, would form the basis of how much money could be created within the economy once the planning process is completed. Currency would be created when it is issued through a worker council payroll system. A decentralized system of checks and balances would be put in place to issue currency similar to how in accounting systems they match invoices to packing slips, and require two signatures to issue a cheque.

Money would be then be created directly from work or effort. In today’s system, it is created by government borrowing/spending and the fractal banking system. This new Parecon system would do away with that.

What if someone wanted to take out a loan to buy a car? How would that work if there are no banks to borrow money from?

Well, let’s say that the car dealership is cooperating with some other monetary type of institution that checks credit scores, etc, would determine whether you qualify for a loan. It would be a very similar process that we have today when credit checks are done on consumers. In other words, if you have enough income to cover payments, you are approved, the car would be produced and workers who produced the car would get paid for their effort, right from the IFB approved WC budget. Once the car is produced, it sits as an asset under the Worker Council that produced it (as a debit). The car is shipped to its new owner who starts to make payments directly to the WC that produced it. As payments come in they would be credited against the asset account under which the car sits or Inventory until it is completely paid off. Note that under no circumstances would there ever be any interest charged on loans.

What if we wanted to build a new state of the art automobile plant, with robotics and the whole thing? Where would the capital come from?

If a long term planning board approves of such a venture, under a Parecon, it would not be necessary to seek actual funding but only approval to build by the IFB and long term planning boards that sit with the automobile makers federation. No capital is needed. All that is needed is an idea and a labour supply. If several proposals are presented and one is ultimately approved, that WC would be granted a budget to spend whatever it needs to build the plant. Workers would be hired and paid until the plant is built.

In short, there is no need to raise capital in a Parecon. All you need are good ideas and a labour supply. The currency is created out of the labour that produces goods that are needed by a society.

C